When I leapt into full-time day trading in October 2020, I entered one of the most exhilarating bull markets in history.

Volatility was high, opportunities were abundant, and gains seemed effortless.

Yet, as I quickly learned, trading isn’t just about strategies and patterns—it’s a psychological battlefield.

My cautious approach, shaped by years of part-time trading, initially held me back in this hyper-inflated market.

But as I gained confidence, I stumbled into a deeper issue: my own behavior was sabotaging my success.

This post explores the behavioral cycles that have defined my trading journey, the psychological traps I’ve uncovered, and my plan to break free.

If you’re a trader—or anyone wrestling with self-limiting patterns—this might resonate.

The Trap of Cycle A: Chasing “More”

Early in my full-time trading, I fell into a false sense of security.

The bull market rewarded bold moves, and I gradually shed my caution, increasing position sizes to capture bigger wins.

Just as I embraced this newfound confidence, the market flipped into a bearish trend.

My strategies, which had worked reliably, faltered.

I scaled back, but the damage was done—I’d missed the peak of the bull run.

Reflecting on my trading logs, I noticed a recurring pattern.

After a string of solid trades—whether over a day, week, or month—I’d feel invincible. I’d take a larger position, often 2-3 times my usual size, only to cut the trade at a loss.

These losses, reasonable in percentage terms, erased my hard-earned gains because of the oversized positions.

I’d rebuild with small wins, regain confidence, and then repeat the cycle.

Every.

Single.

Time.

This wasn’t bad luck—it was me.

I called this Cycle A, a destructive loop fueled by the desire for “more.”

After digging deeper, I realized I was conditioning myself for failure through anticipatory reinforcement.

I fixated on adverse outcomes, expecting trades to go wrong.

When they did, it validated my mindset, trapping me in a negative feedback loop.

Even my successes felt fleeting because I was always chasing bigger wins, never satisfied.

The catalyst?

Wanting more.

This relentless hunger kept me stuck, amplifying losses and undermining my progress.

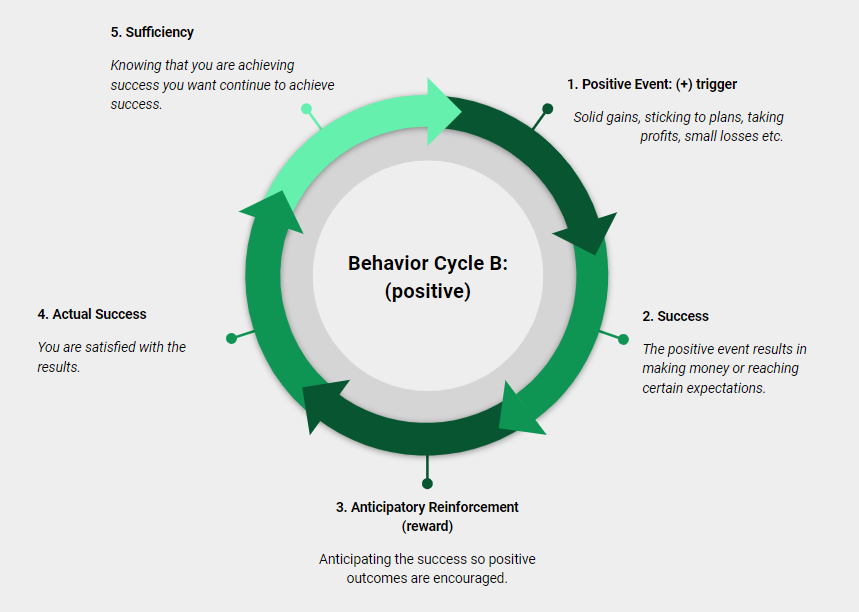

The Promise of Cycle B: Embracing Sufficiency

If negative triggers could lock me in a destructive cycle, could positive triggers set me free?

Enter Cycle B, a new behavioral framework centered on sufficiency and positive reinforcement.

Instead of obsessing over what could go wrong, I’m learning to focus on what’s going right: solid gains, sticking to my trading plan, taking profits, and accepting small losses.

By emphasizing positive triggers, I can practice anticipatory reinforcement for rewards.

This means expecting success and celebrating it when it happens.

When I stick to my plan and see consistent results, I feel satisfied—no need to chase “more.”

The catalyst here is sufficiency—knowing that steady progress compounds into real, lasting success.

Shifting to Cycle B isn’t just about mindset; it’s about rewiring my daily habits.

If I dwell on negative triggers, I risk slipping back into old patterns.

But by consciously reinforcing positive behaviors, I can build a virtuous cycle that drives consistent profitability.

Breaking the Cycle: My Next Steps

My strategies and patterns are sound—my trading logs confirm they deliver the win rate and payouts needed for success.

The missing piece is me.

To become consistently profitable, I must transition from Cycle A to Cycle B and sustain that shift. Here’s how I’m starting:

- Track Positive Triggers: Each day, I’ll note moments of success—executing my plan, taking profits, or managing losses well—to reinforce Cycle B.

- Cap Position Sizes: I’ll stick to predefined position sizes, even after winning streaks, to avoid impulsive over-leveraging.

- Pause and Reflect: Before increasing risk, I’ll take a moment to assess whether I’m acting from sufficiency or chasing “more.”

- Journal Relentlessly: This blog is my accountability tool, helping me spot patterns and stay focused on growth.

I’m confident that mastering Cycle B will transform my profit chart from a negative slope to a steady upward climb.

New challenges will emerge—market conditions, emotional triggers, or strategy tweaks—but I’m ready to tackle them.

This is a journey, and I’m committed to the path ahead.

Why This Matters

Trading exposes the raw edges of human psychology.

My struggle with Cycle A isn’t unique; balancing ambition with discipline is a universal challenge.

Whether trading stocks or pursuing a personal goal, recognizing and reprogramming your behavioral patterns can unlock breakthroughs.

For me, it’s about replacing the urge for “more” with the power of “enough.”

Join me as I navigate this transformation. Share your own cycles or triggers in the comments—I’d love to hear how you’re breaking free.

Comments

Post a Comment