Lessons from a Tough & Choppy SPY Trading Day: Growing a Small Options Trading Account with Discipline

Growing a small trading account is a test of discipline, and today’s SPY trading session was a challenging one, marked by losses but rich with lessons.

I resisted a red-to-green color change at the 20 EMA, mindful of the bearish context below the 200 EMA and the $602 reaction zone overhead, signaling a challenging market environment.

I practiced restraint earlier, but now I am eager to trade despite the lack of a clear trend.

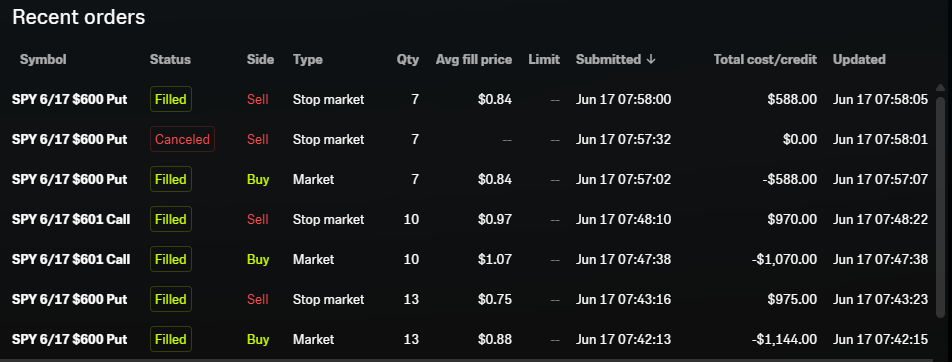

I entered SPY 6/17 600 puts at $0.88 (Entry 1), but my slow stop placement gave it too much room, resulting in a 15% loss at $0.75.

Frustrated, I flipped to SPY 6/17 601 calls at $1.07 and $0.97 (Entry 2), incurring a 9% loss, mistakenly assuming the market would trend in my desired direction, forgetting it does what it wants.

How do you handle tough trading days? Share your strategies in the comments or connect with me on X for more trading insights!

Every trading session, even a tough one, provides valuable insights, and this post offers transparency on my experience to help you scale your account, using today’s struggles as a real-world example.

My goal is to share actionable strategies for navigating challenging market conditions and fostering growth through disciplined trading.

Economic News: U.S. Retail Sales and Market Influences

Today, U.S. retail sales for May 2025 fell by 0.9%, a steeper decline than the expected 0.5% drop, reflecting consumer caution amid trade uncertainties.Additionally, escalating geopolitical tensions, including Israel’s missile strikes on Iran and ongoing tariff threats from President Trump, are driving market volatility and influencing SPY’s choppy behavior.

Today’s SPY Trading Session: A Lesson in Restraint

SPY gapped down below the 20 EMA and 200 EMA from the prior day, bouncing off the previous day’s low around $600.23, tempting me with a reversal entry.However, the gap wasn’t significant enough for the reversion play I sought, so I waited for the 15-minute range to form, which settled between $600.87 and $599.77.

Above, the 200 EMA and a $602 reaction zone loomed as resistance, while $595 marked a deeper support level, suggesting potential fluctuation within this range.

I resisted a red-to-green color change at the 20 EMA, mindful of the bearish context below the 200 EMA and the $602 reaction zone overhead, signaling a challenging market environment.

I entered SPY 6/17 600 puts at $0.88 (Entry 1), but my slow stop placement gave it too much room, resulting in a 15% loss at $0.75.

This wasn’t an A+ setup, as I ignored the 15-minute high and the prior day’s low support.

Frustrated, I flipped to SPY 6/17 601 calls at $1.07 and $0.97 (Entry 2), incurring a 9% loss, mistakenly assuming the market would trend in my desired direction, forgetting it does what it wants.

Calming myself, I waited for clarity, spotting a slight downtrend off the 20 EMA, and entered SPY 6/17 600 puts at $0.84 (Entry 3), setting a breakeven stop that held, avoiding further loss.

Today’s lesson was clear: the market is always right.

When I try to force my own reality on the market, the market wins.

I can only follow my rules and see if they align with the price action.

Cash is a position worth holding in challenging conditions.

Key Observations:

- The gap below the 20 EMA and 200 EMA suggested caution, but my eagerness led to poor entries.

- Waiting for clarity after losses helped me avoid deeper drawdowns, though initial trades suffered.

- Recognizing the lack of trend reinforced the value of restraint over forced action.

Post-Trade Reflection: Every Session Offers Lessons

Today was tough, with a 15% loss and a 9% loss offset by a breakeven trade, but every session provides valuable lessons.I knew this market environment would be challenging, and the thought of sitting out did cross my mind; yet, I overtraded, ignoring the need for clarity.

Days like these, though hard to journal, are critical for growth.

Tomorrow will be the actual test of whether I’ve learned to follow my rules and respect the market’s direction.

Growing a Small Account: Steps to Scale with Discipline

Scaling a small account requires mastering tough days, and today’s session offers a roadmap for success. Here’s how I’m adapting, with tips for other small-account traders:- Adopt a Wait-and-See Approach: Hold off trading in unclear markets, like today’s choppy range, until a clear trend emerges.

- Avoid Forced Entries: Resist tempting setups without confirmation or clarity, as I learned with Entry 1.

- Manage Risk Tightly: Set stops promptly to limit losses, as my delayed stop cost me 15%.

- Embrace Cash as a Position: Sitting out in challenging conditions, as I should have today, preserves capital for better opportunities.

The Power of Transparency: Lessons Fuel Growth

Transparency means sharing struggles and insights—today’s losses highlight the pitfalls of overtrading, yet every session, even a tough one, builds resilience for a small account.These challenging days teach discipline and patience, offering small-account traders a chance to refine their strategies and grow through experience.

Key Takeaways for Aspiring Traders

Every trading day provides insights for small accounts. Here are actionable takeaways:- Wait for Clarity: Avoid trading in choppy ranges without a clear trend.

- Set Stops Early: Prevent large losses by placing stops quickly, unlike my 15% drawdown.

- Respect Market Conditions: Recognize when to hold cash, as the market doesn’t owe you a move.

- Learn from Mistakes: Use tough days to improve, turning losses into opportunities for growth.

Conclusion

Today’s SPY trading session was tough, with losses teaching me restraint, though a breakeven trade showed progress.Every trading session, even a challenging one, provides lessons—stay disciplined, manage risk, and use these insights to grow your small account steadily.

How do you handle tough trading days? Share your strategies in the comments or connect with me on X for more trading insights!

.jpg)

Comments

Post a Comment